About Enchant Energy Corporation (“Enchant”) and Carbon Capture and Sequestration (CCUS )

Who is Enchant Energy Corporation?

Enchant Energy Corporation is a carbon capture and storage (CCS) developer in the United States. We provide CCS as a service to mitigate climate change, ensure reliable energy, preserve and create jobs, and catalyze sustainable development in the communities we serve. We are providing a roadmap for the safe decarbonization of our environment through crucial R&D, world-class partnerships, and a commitment to environmental justice principles.

What is Carbon Capture Utilization and Sequestration?

Carbon Capture Utilization and Sequestration (CCUS) is a term used to describe various methods and technologies that capture carbon dioxide (CO2) from energy and industrial sources and then utilize the captured CO2 for other purposes (such as enhanced oil recovery or EOR), or permanently store it (Sequestration). Carbon capture technologies have been used for years to separate CO2 from gas streams as part of oil and gas operations. In addition, carbon capture technologies have been used on coal and gas fired power plants, cement plants and other industrial processes to capture CO2 that would otherwise have been vented into the atmosphere.

What happens to the carbon dioxide once it has been captured?

Captured CO2 is compressed and then transported by pipeline. Captured CO2 can then be injected underground into geologic formations that have sufficient porosity and permeability in the injection zone, along with non-permeable geological formations above and below the injection zone to allow for reliable permanent storage. Additionally, captured CO2 can also be utilized for the creation of a wide range of products as well as used for enhanced oil recovery (EOR).

What are the main ways that carbon dioxide is captured in energy and industrial processes?

There are four primary methods of capturing carbon dioxide from energy and industrial processes plus an additional method that is independent of industrial processes.

The first is post-combustion carbon capture where CO2 is extracted from flue gas after the combustion of fossil fuels or biomass. The most prominent technology used in post-combustion carbon capture uses amine-based solvents to capture large percentages of CO2 from flue gas.

The second is pre-combustion carbon capture where hydrogen is produced using thermochemical processes (using heat and chemical reactions to release hydrogen) from organic materials, typically natural gas.

A third method is oxy-fuel combustion capture, where the fuel is combusted in the presence of nearly pure (approximately 98%) oxygen to ensure that the products of combustion (flue gas) contain CO2 and water with only trace amounts of other gases.

Finally, Direct Air Capture (DAC) systems use chemical reactions to pull CO2 directly from the atmosphere. Large volumes of air are brought into contact with either liquid solvents or solid sorbents. Once the CO2 is captured, the DAC systems typically apply heat to release the CO2 from the solvent or sorbent.

What is the difference between CCS and CCUS?

CCS refers to carbon capture and sequestration, a process by which captured CO2 is injected into underground geologic formations that have sufficient porosity and permeability in the injection zone, along with non-permeable geological formations above and below the injection zone to allow for reliable permanent storage. CCUS contemplates the possibility of using the captured CO2 for another purpose, such as enhanced oil recovery (EOR), or permanently sequestering it.

Carbon Capture Regulations and Legislative Considerations

How will the California Environmental Performance Standard (EPS) affect Enchant’s plans to export wholesale electricity to the largest power market in the West?

Passed in California in 2009, the California EPS limits the importation of out-of-state, fossil-fuel powered electricity with CO2 emissions more than 1,100 pounds per megawatt-hour. The law triggered the 2015 exit of several California utilities from ownership participation in SJGS. With a projected post-retrofit CO2 emission level of below 250 pounds per megawatt-hour, SGJS will become “environmentally qualified” to export wholesale electricity to California — the largest power market in the West.

What are Section 45Q tax credits?

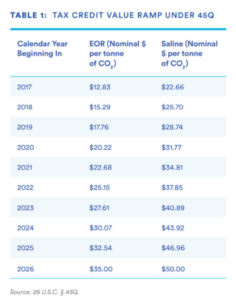

The 45Q tax credit is an increasingly robust and comprehensive carbon capture and utilization deployment incentive valued at up to $85/metric ton for carbon captured and sequestered.

The credit was first enacted in 2008 as part of the Internal Revenue Code (Title 26 of the U.S. Code) and substantially modified in the 2018 FUTURE Act to support investment in productive carbon capture and sequestration investments. Most recently, the Inflation Reduction Act (IRA) of 2022 increased the 45Q tax credit value to $85/metric ton for captured QCO stored in geologic formations, $60/metric ton for the use of captured carbon emissions, and $60/metric ton for QCO stored in oil and gas fields if certain wage and apprenticeship requirements are met. This increase further incentivizes CCUS project development by boosting and making more flexible the investment incentives.

The reformed 45Q tax credit is arguably the most robust and comprehensive carbon capture and utilization deployment incentive in the world today and provides a foundational policy on which to build. The FUTURE Act significantly increases the value of the tax credit, making the investment incentives more attractive for financing of CCUS projects. Applicable to all man-made or anthropogenic sources of CO2, the credit also accommodates the capture and use of both CO2 and CO, extends eligibility to include direct air capture and other forms of carbon utilization beyond enhanced oil recovery, and expands the opportunity for carbon capture deployment to a wider array of industrial facilities.

The expanded 45Q tax credit program is similar to proven wind and solar power production tax credits. Both of those tax credits continue to play a crucial support role in the rapid deployment of wind and solar power generating facilities.

How are CCUS Projects permitted and regulated?

The carbon capture, transport and storage components all have regulatory and permitting requirements. Depending on the specific circumstances of a project, permits and approvals may be required from private, local, state, tribal and federal agencies. While often still in the developmental stage, regulatory frameworks are emerging from numerous government entities.

On the federal level, the Environmental Protection Agency has now promulgated rules and processes that regulate underground injection control programs to ensure the safe long-term sequestration of CO2. The EPA’s Class VI injection well process guides the requirements for the permitting of injecting carbon dioxide into geologic formations in a manner that protects underground sources of drinking water and by providing standards for well construction, operation and maintenance, monitoring and testing, reporting and record-keeping, site closure, financial responsibility, and post injection site care. CCUS projects are now subject to coordinated federal agency review and permitting under the guidance of the Federal Permitting Improvement Steering Council utilizing the FAST-41 process.

In addition, many states have either implemented or are studying the implementation of rules and regulations for CCUS in their respective states. In addition, some states have already asserted primacy for many of the environmental rules, regulations and process related to CCUS, including responsibility for the permitting and regulation of Class VI injection wells.

Decarbonized Energy and its Environmental Impact

Are there any environmental risks associated with implementing CCS and CCUS technology?

CCS and CCUS are proven technologies. Emissions from the carbon capture projects are expected to be at or below the current levels for NOx, Sox, Mercury, and particulate. In addition, projects will be fully compliant with all U.S. and state standards for air and water protection.

What level of CO2 will be emitted after retrofit of existing power plants?

A typical coal-fired power plant will emit approximately 110 pounds or less per megawatt-hour, a 95 percent or greater reduction from the current estimated rate of between 1,100 and 2,200 pounds per megawatt-hour. After the additional of carbon capture, a coal-fired power plant will have carbon dioxide emissions that are less than half of a natural gas fired power plant.

Impact on the Community of Building a Low Carbon Economy

How does Enchant partner with the communities it serves?

Enchant works with the local communities and key partners to create high-quality jobs; fuel a tax base that funds education and services for the surrounding communities; advance principles of environmental justice; and ensure reliable, competitively priced energy.

Will Enchant work with unions?

Enchant Energy will use primarily union workers for construction of our carbon capture projects.

Will the CCS projects have a diverse workforce?

Yes. Enchant Energy is committed to building a diverse workforce for all of the projects we undertake.

Carbon Capture Costs

We hear that carbon capture is prohibitively expensive. What has changed that makes it work now?

While the costs to construct and operate CCS equipment and facilities on existing power plants are significant, improvements in carbon capture technologies, the favorable cost structures for the power plants where CCS will be added, and Internal Revenue Code Section 45Q tax credits are the three main factors that make CCS projects economically beneficial for power plants, electricity customers, and investors in CCS.

What technical, operational and financial expertise does Enchant Energy Corporation bring to the project?

Enchant’s executive team has decades of operational excellence in energy project development and operation. Enchant is partnering with world-class energy investors and innovators, including: Derivee Power, Navajo Transitional Energy Company (NTEC), and other organizations that have experience and expertise in CCS including; Mitsubishi Heavy Industries America, Sargent & Lundy, Kiewit Power, Los Alamos National Lab, Sandia National Laboratories, New Mexico Institute of Mining and Technology, the New Mexico Bureau of Geology, University of New Mexico, University of Utah, and University of Wyoming.

What are the costs, benefits, and other factors of the various approaches to carbon capture?

Each carbon capture approach has technological, economic, legal, and regulatory factors that will impact and drive their use. Capital costs of the carbon capture system components, energy cost, whether electricity or primary fuels like coal or natural gas, the cost of water, the cost of chemical solvent or sorbents, plus the cost of labor are all important factors to be considered. While there is no one-size-fits-all analysis for the technologies or projects that will utilize carbon capture, all must address the wide range of factors listed above.