Enchant Energy Corporation is helping to secure America’s economic prosperity and national security by supporting domestic energy-intensive industries. Energy demand by current and emerging technologies — including artificial intelligence, re-industrialization, defense, and transportation — is rapidly accelerating. Expanding energy production capacity will be a differentiator for the U.S. to outpace global competitors, drive innovation, and create millions of new jobs.

“At Enchant, our mission is to support the “clean” use of fossil fuels to meet this demand and lead the way for U.S. energy independence.” Jim Wolff, CEO

America’s energy security relies on fossil fuels to maintain ample and reliable baseload power generation to satisfy growing demand for electricity. Decarbonizing U.S. power generation and industrial manufacturing preserves billions of dollars of installed infrastructure and numerous jobs. It also safeguards U.S. energy supply by providing a critical input to increase domestic oil production all while working to mitigate climate change and catalyze sustainable development in the communities we serve. Through crucial R&D and world-class partnerships, we provide a roadmap for the safe decarbonization of our environment.

Enchant provides carbon capture, utilization, and sequestration as a service to emitters, oil and gas companies, sequestration and transportation companies, and other utilizers of carbon dioxide.

We develop carbon capture facilities for fossil fuel power plants and industrial emitters by retrofitting them with proven, modular, and cost-effective post-combustion carbon capture technologies that can be implemented quickly. We partner with carbon management companies to provide the captured carbon dioxide for enhanced oil recovery, sequester the it by permanent geological storage, or convert it into marketable products. Our projects are designed to qualify for IRS §45Q tax credits.

We are a one-stop-shop for all your decarbonization needs. We offer a comprehensive solutions to fill the gap in the marketplace between the emitters and the users of CO2 and to safeguard American energy.

Check out our solutions, projects underway at Four Corners Power Plant and a Kansas Power Plant and our emerging technologies.

Frequently Asked Questions

What is Carbon Capture, Utilization, and Storage?

Carbon Capture, Utilization, and Storage (CCUS) is a term used to describe various methods and technologies that capture carbon dioxide (CO2) from energy, industrial sources, and the atmosphere and then either sequestor it underground by enhanced oil recovery (EOR) or permanent storage in geological formations, or utilize the captured CO2 as a raw material to make otehr products. Carbon capture technologies have been used for years to separate CO2 from gas streams as part of oil and gas operations. In addition, carbon capture technologies have been used on coal and gas fired power plants, cement plants and other industrial processes to capture CO2 that would otherwise have been vented into the atmosphere.

What happens to the carbon dioxide once it has been captured?

Captured CO2 is compressed and then transported typically by pipeline. Captured CO2 can then be injected underground into for enhanced oil recovery (EOR) or permanent storage in geologic formations that have sufficient porosity and permeability in the injection zone, along with non-permeable geological formations above and below the injection zone to allow for reliable permanent storage. Additionally, captured CO2 can also be utilized for the creation of a wide range of products.

What are the main ways that carbon dioxide is captured in energy and industrial processes?

There are four primary methods of capturing carbon dioxide from energy and industrial processes plus an additional method that is independent of industrial processes.

The first is post-combustion carbon capture where CO2 is extracted from flue gas after the combustion of fossil fuels or biomass. The most prominent technology used in post-combustion carbon capture uses amine-based solvents to capture large percentages of CO2 from flue gas.

The second is pre-combustion carbon capture where hydrogen is produced using thermochemical processes (using heat and chemical reactions to release hydrogen) from organic materials, typically natural gas.

A third method is oxy-fuel combustion capture, where the fuel is combusted in the presence of nearly pure (approximately 98%) oxygen to ensure that the products of combustion (flue gas) contain CO2 and water with only trace amounts of other gases.

Finally, Direct Air Capture (DAC) systems use chemical reactions to pull CO2 directly from the atmosphere. Large volumes of air are brought into contact with either liquid solvents or solid sorbents. Once the CO2 is captured, the DAC systems typically apply heat to release the CO2 from the solvent or sorbent.

What are Section 45 Tax Credits?

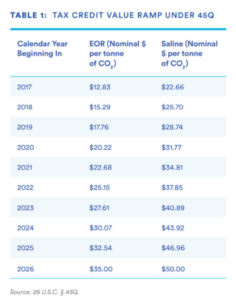

The 45Q tax credit is an increasingly robust and comprehensive carbon capture and utilization deployment incentive valued at up to $85/metric ton for carbon captured and sequestered.

The credit was first enacted in 2008 as part of the Internal Revenue Code (Title 26 of the U.S. Code) and substantially modified in the 2018 FUTURE Act to support investment in productive carbon capture and sequestration investments. Most recently, the Inflation Reduction Act (IRA) of 2022 increased the 45Q tax credit value to $85/metric ton for captured QCO stored in geologic formations, $60/metric ton for the use of captured carbon emissions, and $60/metric ton for QCO stored in oil and gas fields if certain wage and apprenticeship requirements are met. This increase further incentivizes CCUS project development by boosting and making more flexible the investment incentives.

The reformed 45Q tax credit is arguably the most robust and comprehensive carbon capture and utilization deployment incentive in the world today and provides a foundational policy on which to build. The FUTURE Act significantly increases the value of the tax credit, making the investment incentives more attractive for financing of CCUS projects. Applicable to all man-made or anthropogenic sources of CO2, the credit also accommodates the capture and use of both CO2 and CO, extends eligibility to include direct air capture and other forms of carbon utilization beyond enhanced oil recovery, and expands the opportunity for carbon capture deployment to a wider array of industrial facilities.

The expanded 45Q tax credit program is similar to proven wind and solar power production tax credits. Both of those tax credits continue to play a crucial support role in the rapid deployment of wind and solar power generating facilities.

We hear that carbon capture is prohibitively expensive. What has changed that makes it work now?

While the costs to construct and operate carbon capture equipment and facilities on power plants and industrial emitters are significant, improvements in carbon capture technologies, the favorable cost structures for the power plants where CCUS will be added, and Internal Revenue Code Section 45Q tax credits are the three main factors that make CCS projects economically beneficial for power plants, electricity customers, and investors in CCUS.

What are the costs, benefits, and other factors of the various approaches to carbon capture?

Each carbon capture approach has technological, economic, legal, and regulatory factors that will impact and drive their use. Capital costs of the carbon capture system components, energy cost, whether electricity or primary fuels like coal or natural gas, the cost of water, the cost of chemical solvent or sorbents, plus the cost of labor are all important factors to be considered. While there is no one-size-fits-all analysis for the technologies or projects that will utilize carbon capture, all must address the wide range of factors listed above.

What technical, operational and financial expertise does Enchant Energy Corporation bring to the project?

Enchant’s executive team has decades of operational excellence in energy project development and operation. Enchant is partnering with world-class energy investors and innovators, including: Derivee Power, Navajo Transitional Energy Company (NTEC), and other organizations that have experience and expertise in CCUS including; Mitsubishi Heavy Industries America, Sargent & Lundy, Kiewit Power, Los Alamos National Lab, Sandia National Laboratories, New Mexico Institute of Mining and Technology, the New Mexico Bureau of Geology, University of New Mexico, University of Utah, and University of Wyoming.